What is accidental damage cover?

As the classic saying goes: “accidents will happen”, and they often do, particularly around the home.

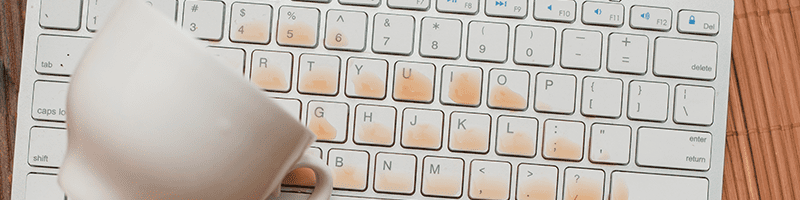

If you accidentally knocked over a full glass of red wine or a steaming hot mug of black coffee, staining and ruining a section of your plush living room carpet, would your home insurance cover the cost of repair or replacement?

If you’re not sure, don’t automatically assume your home insurance policy will provide cover for damage caused by accidents. If ‘accidental damage’ doesn’t feature on your insurance policy, it’s unlikely to cover these types of accident.

Many home insurance providers won’t provide accidental damage as standard. With RAC Home Insurance it’s available as an optional extra, to add to your main policy.

What is accidental damage?

You should check with your insurer to confirm the definition of accidental damage, as it may differ from policy to policy. Usually, accidental damage relates to a one-off incident that causes damage to your home or its contents – a spillage, a breakage, or even something like putting your foot through the floor of your loft.

Dropping a laptop, resulting in its screen being smashed, would probably qualify as accidental damage. So, too, would one of your children running into the TV, causing it to fall and crack the screen. But wear and tear over time – that same laptop failing to work after several years – wouldn’t be classed as accidental damage.

Bear in mind, too, that while accidental damage may cover any accidents involving your children, the same might not be extended to pets you have in the house. A dog that chews half your newly-purchased sofa to bits and pieces may just leave you footing a hefty and unwelcome bill, so do check with your insurer as to whether accidental damage has a pet clause.

You might also want to consider adding accidental damage to your buildings insurance and your contents insurance, so you’re covered when it comes to your property and your possessions.

Having accidental damage cover on your contents will provide protection for that dreaded red wine stain. Having accidental damage cover as part of your buildings insurance should see you covered if you’re hanging a picture on the wall and mistakenly hammer a nail through a water pipe, causing it to burst.

It’s also a good idea to check for any exclusions that might apply ahead of a DIY project. If you’re redecorating or renovating, check with your insurer to see whether this might affect any potential claims.

And, if you have single items of high value, for example an expensive watch, you might want to list them as a specified item on your policy to ensure it’s covered.

What other optional home insurance extras are available?

In addition to accidental damage cover, you might also want to add other optional extras to your home insurance policy. Common optional home insurance extras include:

Home Assistance Cover – this provides cover for any home emergencies, such as boiler, heating and plumbing issues. It may also cover you for alternative accommodation if you need to leave your home for a period of time while repairs are being carried out.

Key cover – this provides cover if you lose your keys or they’re stolen. This type of cover usually enables you to get assistance from a locksmith and get replacement locks fitted, if needed.

Family Legal Protection – this can provide financial support for legal costs, the provision of a legal helpline, and the means to help recover loss of earnings, if required.

Looking for home insurance? Buy online and get immediate cover